Next enter how much money you intend to deposit or withdrawal periodically. First, enter your initial amount you have set aside, then enter the interest rate along with how long you tend to invest for. Use this calculator to quickly figure out how much money you will have saved up during a set investment period. Select "never" on frequency if no recurring transactions are made.Įnter "0" in fields if you do not wish to adjust results. Nottingham Building Society, Nottingham House, 3 Fulforth Street, Nottingham, NG1 3DL.Quickly Calculate Compound Interest 💵 On Lump Sum and/or Regular Deposits Into a High Yield Savings Account Your Initial DepositĮnter "0" for initial savings if there is no initial deposit. Registered Office: Capital House, Pride Place, Derby DE24 8QR Registered in England number: 6003803 (FCA FRN 466154).īeehive Money is a trading name of Nottingham Building Society which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered Office: Capital House, Pride Place, Derby DE24 8QR Registered in England number: 3368205 (FCA FRN 455545). Mortgage Advice Bureau is a trading name of Mortgage Advice Bureau Limited and Mortgage Advice Bureau (Derby) Limited which are authorised and regulated by the Financial Conduct Authority. The fee is up to 1.00% but a typical fee is 0.30% of the amount borrowed.īeehive Money is an introducer to Mortgage Advice Bureau for mortgage advice and protection. The actual amount you pay will depend upon your circumstances. Your home may be repossessed if you do not keep up repayments on your mortgage. Whichever monthly money planner approach you opt for, re-visiting it often is a great way to keep on top of your budget. We also have a mortgage calculator which could double up as a mortgage budget planner for the future as it can help you work out what your monthly repayments could be. Saving for a deposit on a house is a hot topic here at Beehive and using a budget builder such as this one can help you work out how much you have left from your monthly income to save. How much do I need to save for a deposit? No more wondering ‘where did my money go?!’. At the end you should be left with £0.00 as everything from your monthly income has been allocated somewhere.Remember to add in adhoc budgets into your money planner for discretional spending such as eating out, gifting, hair or grooming treatments, shopping etc – everything should have a budget or an exact price.For example, £300 into your Lifetime ISA or £100 into your holiday pot and £50 into an emergency fund. Take away your savings from what’s left.

For example, if you pay £7.99 for a subscription service, log this as the cost, not £8.

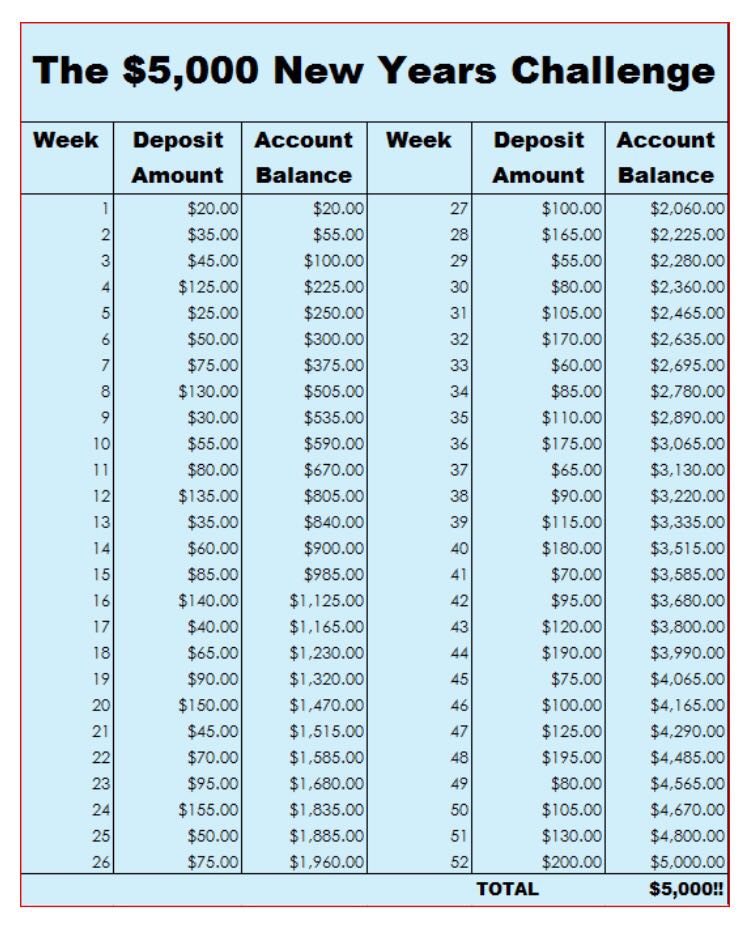

YEAR SAVINGS PLANNER UPDATE

The less you spend, the more you can save towards the deposit for your first house, that kitchen update or holiday of a lifetime. Getting a budget or a savings planner in place is the first step to seeing what you spend and how much you can save.

0 kommentar(er)

0 kommentar(er)